Brilliant Strategies Of Info About How To Help Your Credit Score

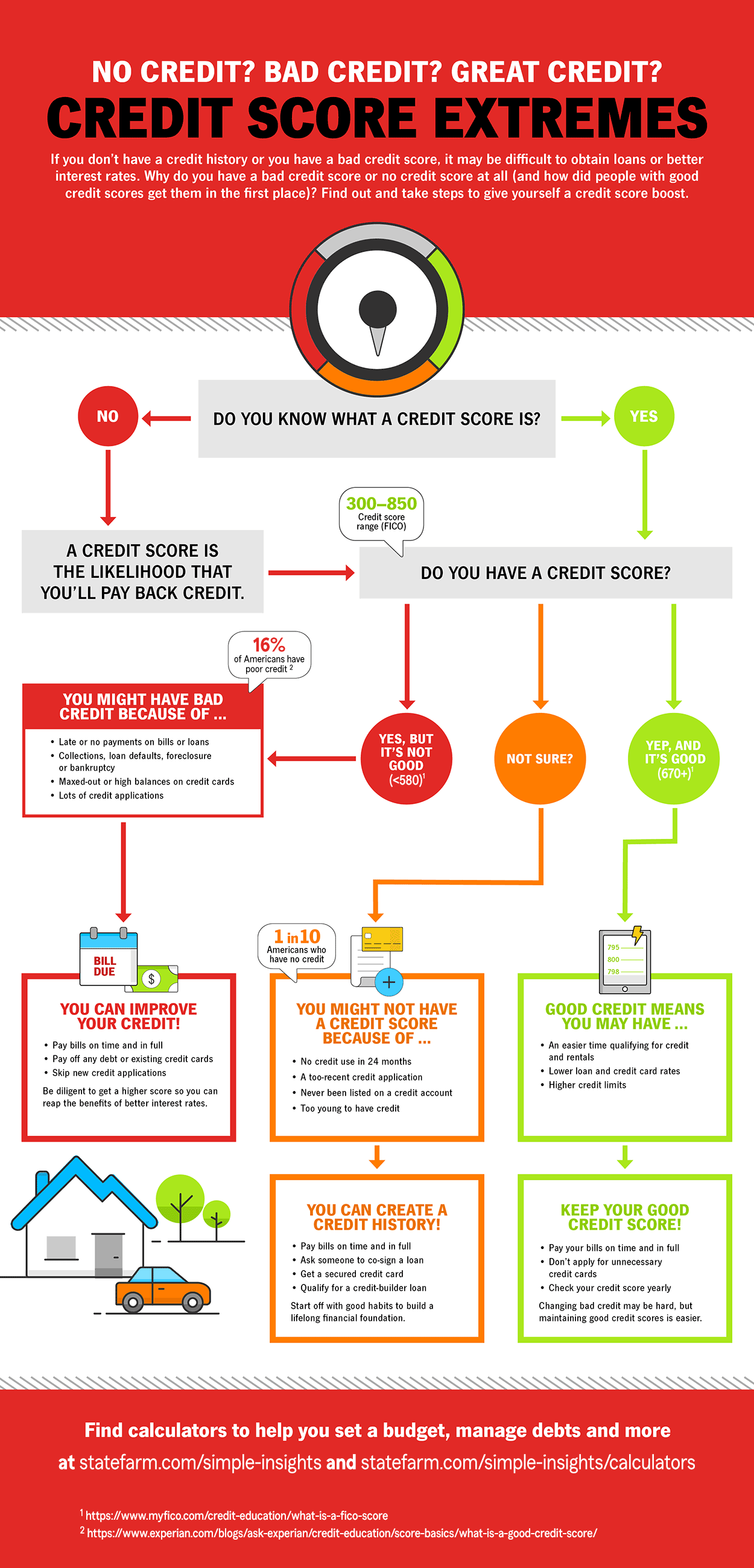

New credit scores take effect immediately.

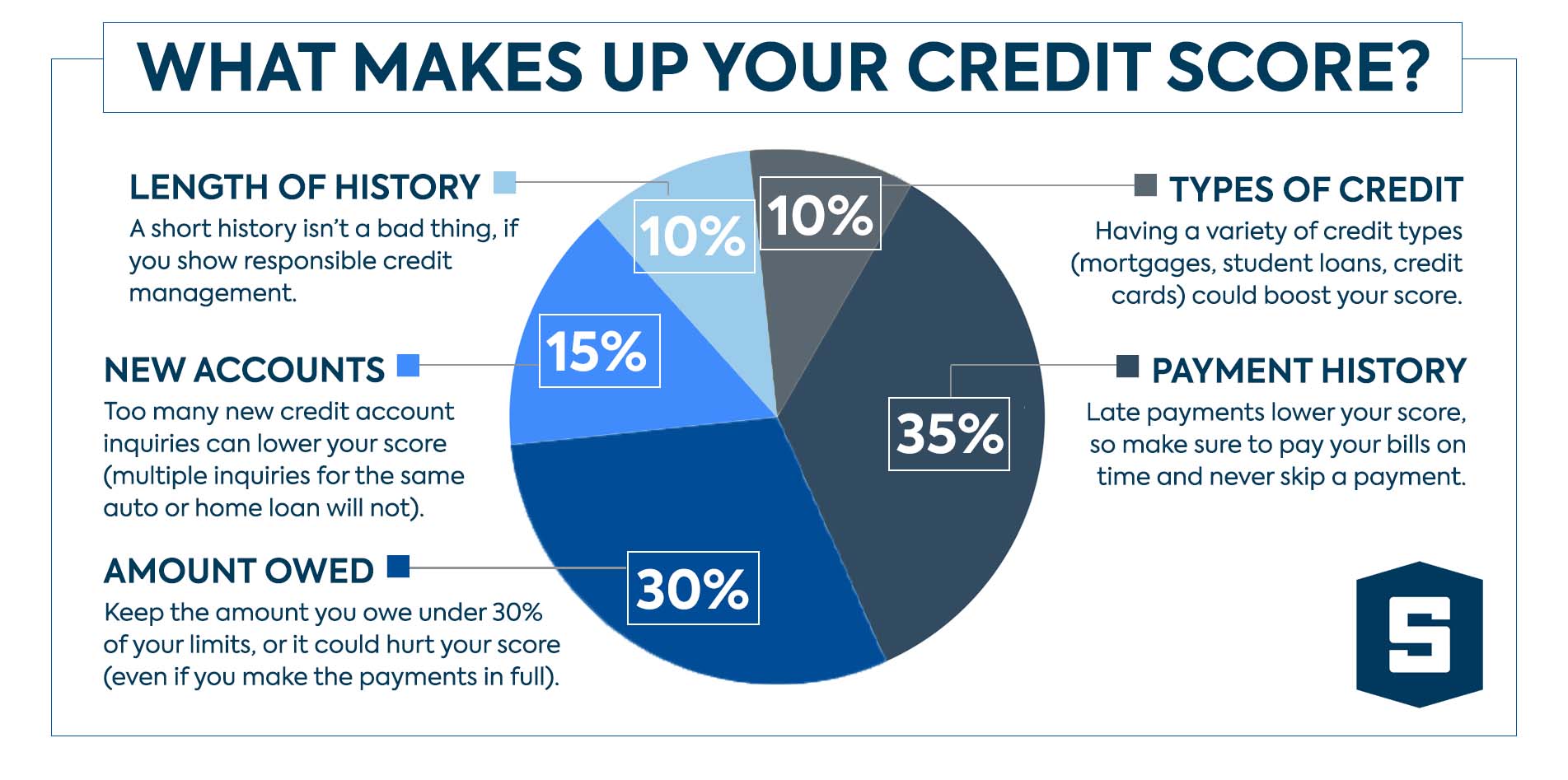

How to help your credit score. Payment history accounts for the largest share of your credit score, so it’s extremely important to always pay your bills on. The bigger your debt is, and the more recent your missed payments are, the. Your scores often take into account the size of your debt and the timing of your missed payments.

To improve your credit, it helps to know what might be. Staying organized can help your credit scores as well: The key is to avoid making new purchases on your old cards once you've cleared those.

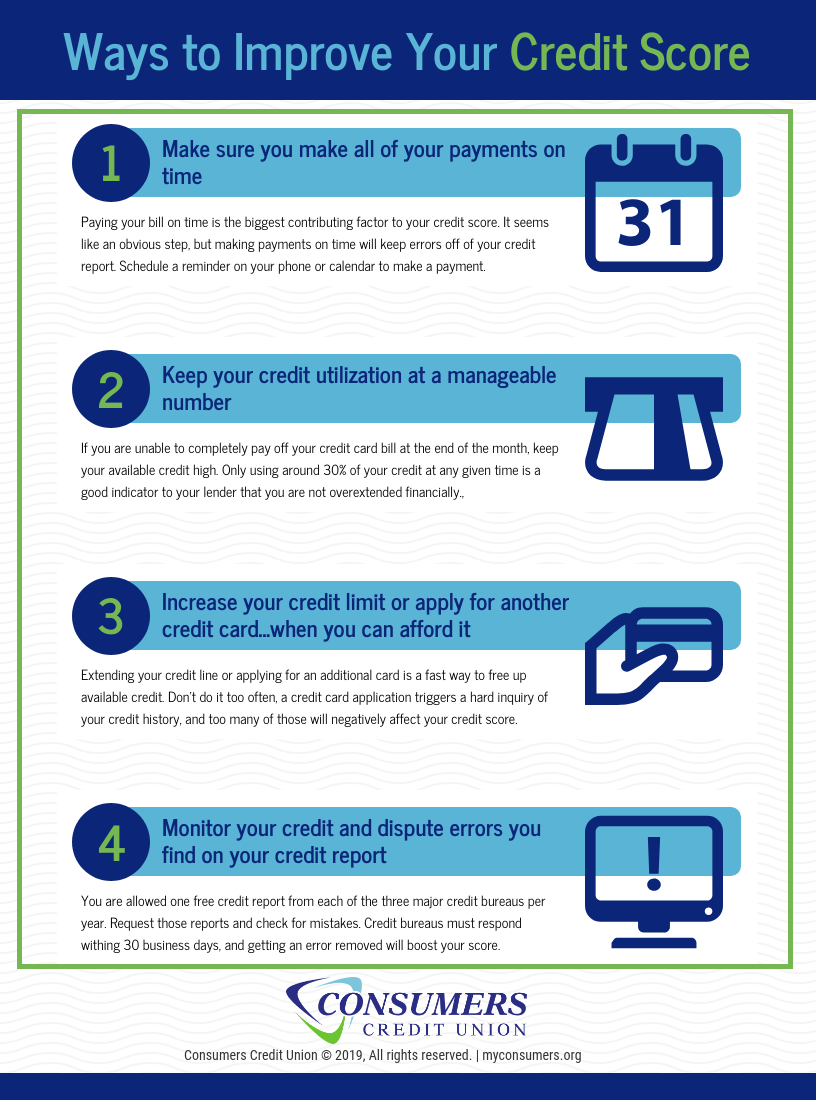

Automate and make your bill payments on time. Review your credit reports (should take an afternoon). When you apply for a loan or credit card, lenders fetch your credit report from the bureaus to gauge your creditworthiness.

Under fico 9, paid collections no longer harm a. Ad you can increase your fico® score for free. To help stay on budget and avoid the big, scary january credit card bill, be sure to track your.

Pay your bills on time. How to build my credit score fast, help to improve credit. This clever tool will help you work out how much you can afford to borrow, using calculations based on your income and estimated spending.

While these numbers serve as a baseline, those in the business of credit feel the. Generally, the longer your total credit history, the more it will help your credit score. Under the fico score model, it's best to keep your credit utilization rate below 30%.