Cool Tips About How To Apply For A Home Loan Modification

Up to 25% cash back apply for a modification as soon as possible.

How to apply for a home loan modification. You’ll need to provide federal tax returns for the past two years as part of your financial picture. You will send in the following: If you’re considering a loan modification, there are a few things you should know.

Also, explain the various reasons. Let's clarify more about mortgage loan modification procedure. Extending the length of your loan up to 40 years.

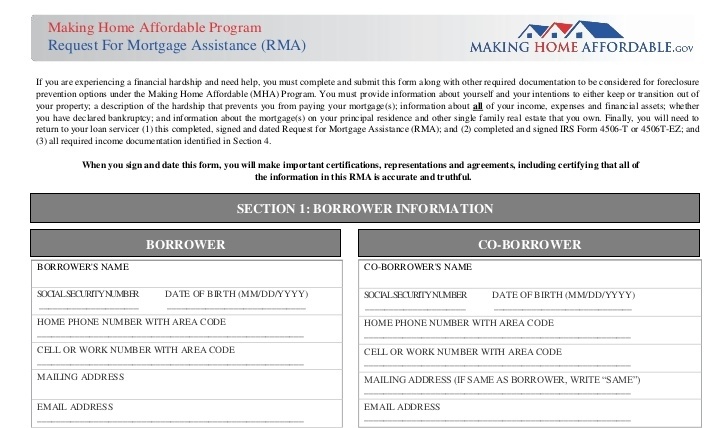

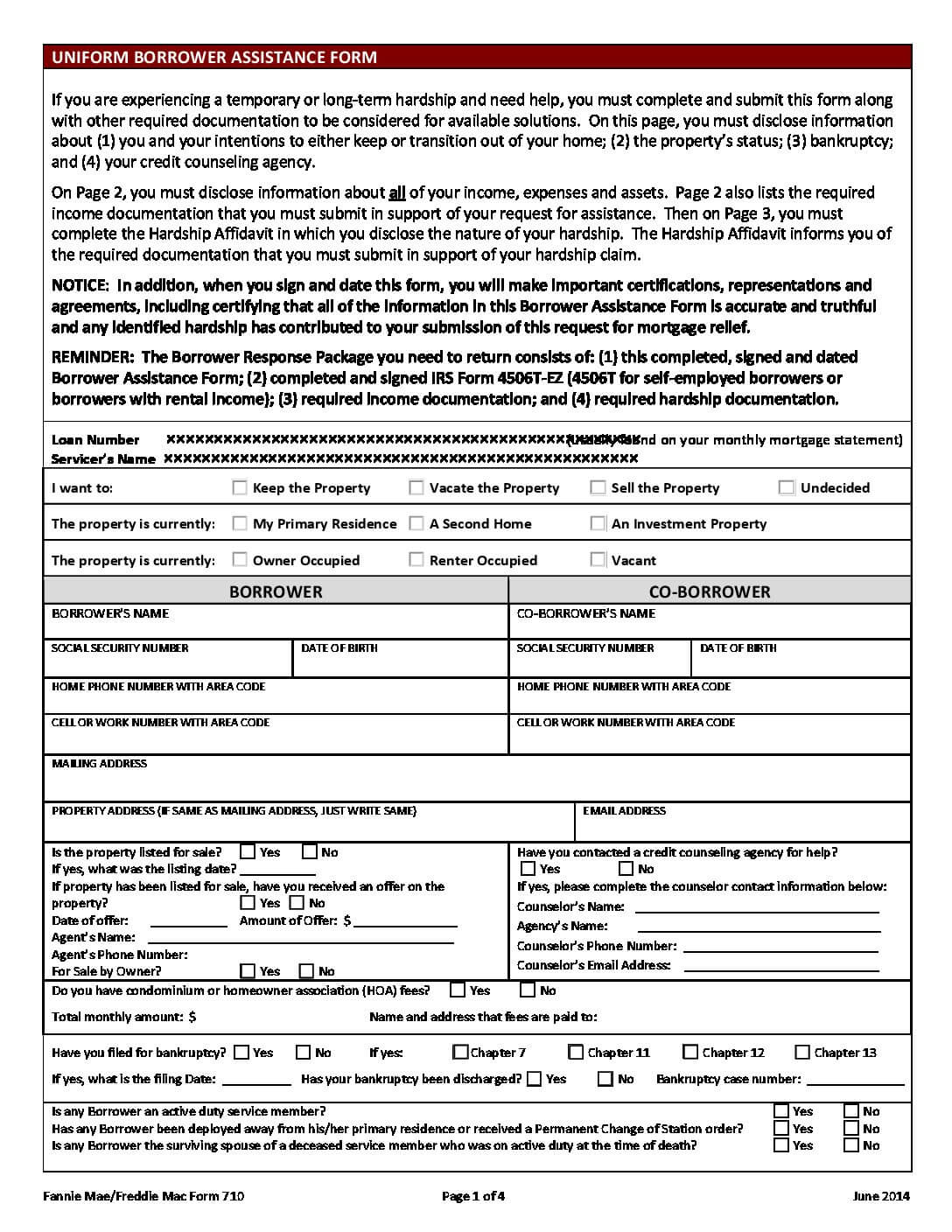

The largest program within mha is the home affordable modification program (hamp). If you have experienced a financial hardship that resulted in the inability to pay your mortgage payments, or you anticipate that you may have trouble paying your mortgage. The home modification loan program provides no interest loans to modify the homes of adults and children with disabilities.

Ad we're america's largest mortgage lender. Up to 25% cash back how to apply for a loan modification. How you can apply for a loan modification:

A loan modification changes your loan permanently, so it may not be an option if you're facing a temporary hardship. If you have home equity financing or any other liens on the property, they. Compare mortgage options & calculate payments.

To apply for a modification, contact your servicer's loss mitigation department, sometimes called a home retention. First, you’ll need to contact your lender and explain your situation. Gather your federal tax returns.