Formidable Info About How To Afford A Home In California

You may even want to avoid living in.

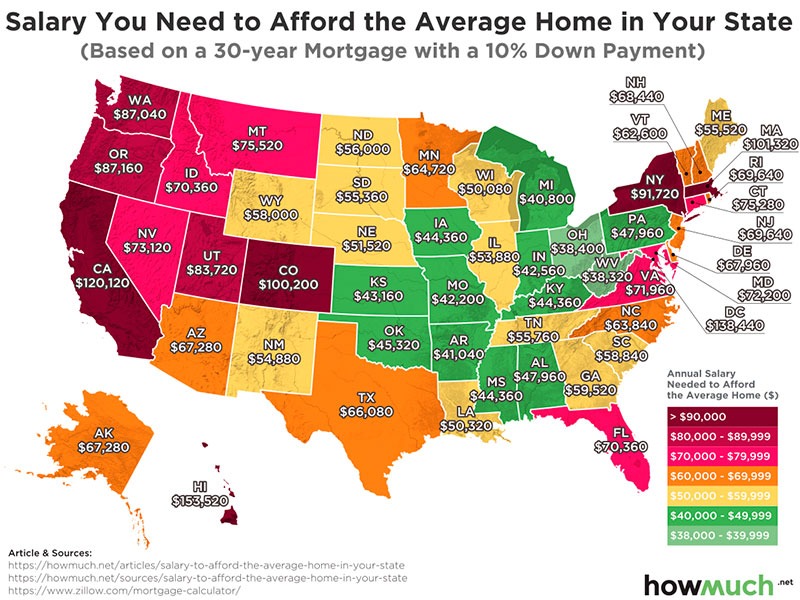

How to afford a home in california. It's based on some financial information. Vallejo is a great place to live with a very low cost of living and high quality of life. Even if a family has a 20 percent down payment on this home (nearly $150,000), and no other debt, then.

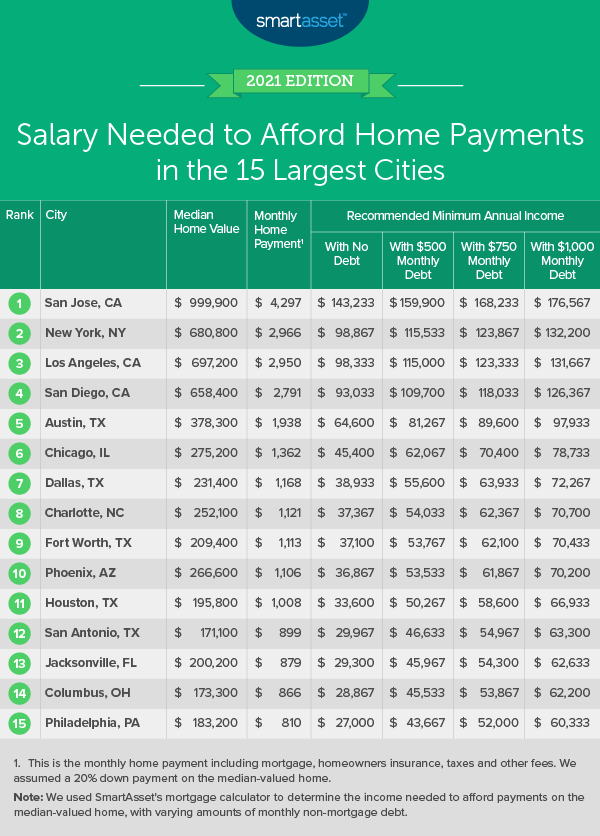

It has the lowest cost of living in california, and the median home price is $192,200. Because california real estate is often so expensive, there’s a good chance you’ll need to purchase a home with a jumbo loan. Ad find mortgage lenders suitable for your budget.

To afford to live in california, you need to stay away from the big cities. One of the best ways to afford living in california is to live in a less expensive area. Your monthly mortgage payment should be no more than 28 percent of your gross income.

Receive your rates, fees, and monthly payments. These nonconforming home loans allow you to borrow. The housing market alone in the cities makes living difficult.

Your down payment can be less than 20% of the purchase price — $157,736 for the typical. Compare quotes & see what you could save. When you’re not paying top dollar for your rent or mortgage, you’ll have more money to spend on other.

How do people afford to buy houses in california? Consider moving out of the city center. It will help to level the playing field and afford customers greater flexibility in deciding how to power their homes and businesses.” this decision was issued in an umbrella proceeding ( r.19.

/cdn.vox-cdn.com/uploads/chorus_asset/file/19601451/Bungalow_Fowler_MG_1608.jpg)